cvCovEst: Cross-Validated

Covariance Matrix Estimation

Philippe Boileau, Brian Collica, Nima Hejazi

2022-12-07

Source:vignettes/using_cvCovEst.Rmd

using_cvCovEst.RmdBackground and Motivation

When the number of observations in a dataset far exceeds the number of features, the estimator of choice for the covariance matrix is the sample covariance matrix. It is an efficient estimator under minimal regularity assumptions on the data-generating distribution. In high-dimensional regimes, however, this estimator leaves much to be desired: The sample covariance matrix is either singular, numerically unstable, or both, thereby amplifying estimation error.

As high-dimensional data have become widespread, researchers have derived many novel covariance matrix estimators to remediate the sample covariance matrix’s deficiencies. These estimators come in many flavours, though most are constructed by regularizing the sample covariance matrix, or through the estimation of latent factors. A comprehensive review is provided by Fan, Liao, and Liu (2016).

This variety brings with it many challenges. Identifying an “optimal” estimator from among a collection of candidates can prove a daunting task, one whose objectivity is often compromised by the analyst’s decisions. Though data-driven approaches for selecting an optimal estimator from among estimators belonging to certain (limited) classes have been derived, the question of selecting an estimator from among a diverse collection of candidates remains unaddressed.

We therefore offer a general, cross-validation-based framework for covariance matrix estimator selection to tackle just that. The high-dimensional asymptotic optimality of selections are guaranteed based upon extensions of the seminal work of Dudoit and van der Laan (2003), Dudoit and van der Laan (2005), and van der Vaart, Dudoit, and van der Laan (2006) on data-adaptive estimator selection to high-dimensional covariance matrix estimation (Boileau et al. 2021). The interested reader is invited to review theoretical underpinnings of the methodology as described in Boileau et al. (2021).

Cross-validated Covariance Matrix Estimation

Let there be a high-dimensional dataset comprising \(n\) realizations of \(i.i.d.\) \(p\)-length random vectors with a possibly nonparametric data-generating distribution. Our goal is to estimate these random vectors’ covariance matrix, which may be accomplished using our general cross-validated estimator selection framework.

Given a library of candidate estimators, a loss function, and a

choice of cross-validation scheme, cvCovEst() will identify

the asymptotically optimal estimator of the covariance matrix from among

all candidates. It subsequently estimates this parameter using the

selected candidate. An example is provided below. Lists and brief

descriptions of implemented candidate estimators, loss functions, and

cross-validation schemes are provided in the sequel.

## Warning: package 'MASS' was built under R version 4.1.2## cvCovEst v1.2.0: Cross-Validated Covariance Matrix Estimation

set.seed(1584)

# generate a 50x50 covariance matrix with unit variances and off-diagonal

# elements equal to 0.5

sigma <- matrix(0.5, nrow = 50, ncol = 50) + diag(0.5, nrow = 50)

# sample 50 observations from multivariate normal with mean = 0, var = Sigma

dat <- mvrnorm(n = 50, mu = rep(0, 50), Sigma = sigma)

# run CV-selector

cv_cov_est_out <- cvCovEst(

dat = dat,

estimators = c(

linearShrinkLWEst, denseLinearShrinkEst,

thresholdingEst, poetEst, sampleCovEst

),

estimator_params = list(

thresholdingEst = list(gamma = c(0.2, 0.4)),

poetEst = list(lambda = c(0.1, 0.2), k = c(1L, 2L))

),

cv_loss = cvMatrixFrobeniusLoss,

cv_scheme = "v_fold",

v_folds = 5,

)

# print the table of risk estimates

cv_cov_est_out$risk_df## # A tibble: 9 × 3

## estimator hyperparameters cv_risk

## <chr> <chr> <dbl>

## 1 linearShrinkLWEst hyperparameters = NA 357.

## 2 poetEst lambda = 0.2, k = 1 369.

## 3 poetEst lambda = 0.2, k = 2 372.

## 4 poetEst lambda = 0.1, k = 2 375.

## 5 poetEst lambda = 0.1, k = 1 376.

## 6 denseLinearShrinkEst hyperparameters = NA 379.

## 7 sampleCovEst hyperparameters = NA 379.

## 8 thresholdingEst gamma = 0.2 384.

## 9 thresholdingEst gamma = 0.4 505.

# print a subset of the selected estimator's estimate

cv_cov_est_out$estimate[1:5, 1:5]## [,1] [,2] [,3] [,4] [,5]

## [1,] 1.1725637 0.5219385 0.4813226 0.5576840 0.6719526

## [2,] 0.5219385 0.9364171 0.5591108 0.4390799 0.6766744

## [3,] 0.4813226 0.5591108 1.0150440 0.4052703 0.6436765

## [4,] 0.5576840 0.4390799 0.4052703 0.9826984 0.4304168

## [5,] 0.6719526 0.6766744 0.6436765 0.4304168 1.0883278Candidate Estimators

Covariance matrix estimators implemented in the cvCovEst

package are catalogued in the following table. These estimators are fed

to the cvCovEst() function through the

estimators argument as a vector. If these estimators rely

on hyperparameters, then they must be passed to the

estimator_params as a list. Depending on one’s assumptions

— or lack thereof — about the true covariance matrix, one may choose to

use a subset of these estimators or all of them. Of course, they may

also be used as standalone functions.

| Estimator | Implementation | Description |

|---|---|---|

| Sample covariance matrix | sampleCovEst() |

The sample covariance matrix. |

| Hard thresholding (Bickel and Levina 2008b) | thresholdingEst() |

Applies a hard thresholding operator to the entries of the sample covariance matrix. |

| SCAD thresholding (Rothman, Levina, and Zhu 2009; Fan and Li 2001) | scadEst() |

Applies the SCAD thresholding operator to the entries of the sample covariance matrix. |

| Adaptive LASSO (Rothman, Levina, and Zhu 2009) | adaptiveLassoEst() |

Applies the adaptive LASSO thresholding operator to the entries of the sample covariance matrix. |

| Banding (Bickel and Levina 2008a) | bandingEst() |

Replaces the sample covariance matrix’s off-diagonal bands by zeros. |

| Tapering (Cai, Zhang, and Zhou 2010) | taperingEst() |

Tapers the sample covariance matrix’s off-diagonal bands, eventually replacing them by zeros. |

| Optimal Linear Shrinkage (Ledoit and Wolf 2004) | linearShrinkLWEst() |

Asymptotically optimal shrinkage of the sample covariance matrix towards the identity. |

| Linear Shrinkage (Ledoit and Wolf 2004) | linearShrinkEst() |

Shrinkage of the sample covariance matrix towards the identity, but the shrinkage is controlled by a hyperparameter. |

| Dense Linear Shrinkage (Schäfer and Strimmer 2005) | denseLinearShrinkEst() |

Asymptotically optimal shrinkage of the sample covariance matrix towards a dense matrix whose diagonal elements are the mean of the sample covariance matrix’s diagonal, and whose off-diagonal elements are the mean of the sample covariance matrix’s off-diagonal elements. |

| Nonlinear Shrinkage (Ledoit and Wolf 2018) | nlShrinkLWEst() |

Analytical estimator for the nonlinear shrinkage of the sample covariance matrix. |

| POET (Fan, Liao, and Mincheva 2013) | poetEst() |

An estimator based on latent variable estimation and thresholding. |

| Robust POET (Fan, Liu, and Wang 2018) | robustPoetEst() |

A robust (and more computationally taxing) take on the POET estimator. |

| Spiked Operator Loss Shrinkage (Donoho, Gavish, and Johnstone 2018) | spikedOperatorShrinkEst() |

The asymptotically optimal shrinkage estimator based on the operator loss in a Gaussian spiked covariance model. |

| Spiked Frobenius Loss Shrinkage (Donoho, Gavish, and Johnstone 2018) | spikedFrobeniusShrinkEst() |

The asymptotically optimal shrinkage estimator based on the Frobenius loss in a Gaussian spiked covariance model. |

| Spiked Stein Loss Shrinkage (Donoho, Gavish, and Johnstone 2018) | spikedSteinShrinkEst() |

The asymptotically optimal shrinkage estimator based on the Stein loss in a Gaussian spiked covariance model. |

Note that cvCovEst() only functions with estimators

native to this package. If you’d like to request a new estimator

implementation, please submit an issue to the

queue.

Loss Functions

Given a collection of candidate estimators, cvCovEst()

compares their conditional cross-validated risks to identify the optimal

selection. The loss function used to compute these risks should reflect

both aspects of the data-generating distribution and the goal of the

estimation procedure. This package currently implements three loss

functions:

| Loss | Implementation | Description |

|---|---|---|

| Matrix-based Frobenius | cvMatrixFrobeniusLoss() |

The default, based on the Frobenius norm. Appropriate when the dataset’s features are of similar magnitudes. |

| Variance-scaled matrix-based Frobenius | cvScaledMatrixFrobeniusLoss() |

A scaled version of the matrix-based Frobenius loss, where weights are the inverse of products from the sample covariance matrix’s diagonal. Appropriate when the features of the dataset are of different magnitudes. |

| Observation-based Frobenius | cvFrobeniusLoss() |

Based on the Frobenius norm and the rank-1, observation-level estimates of the sample covariance matrix. Its selections are equivalent to that of the matrix-based Frobenius, though less computationally efficient. However, the optimality results of Boileau et al. (2021) rely on it. |

The choice of loss function is set trough the cv_loss

argument. Like the candidate estimators, cvCovEst() only

supports loss functions implemented in this package. Please submit

suggestions to the issue

queue.

Supported Cross-Validation Schemes

Two cross-validation schemes are currently supported by

cvCovEst(). Please consider filing an issue in the

queue to request the implementation of another cross-validation

scheme.

| Scheme | Details |

|---|---|

| V-fold | To use V-fold cross-validation, set the cv_scheme

argument in cvCovEst() to "v_fold", and set

the number of folds through the v_folds argument.

cvCovEst() defaults to 5-fold cross-validation. |

| Monte-Carlo | To perform Monte-Carlo cross-validation, set the

cv_scheme argument to "mc". Set the proportion

of data to be used in each validation set using the

mc_split argument, and the number of iterations to perform

with the v_folds argument. |

Diagnostic Tools

In addition to selecting an optimal estimator, the

cvCovEst package contains summary and plotting methods

which highlight the statistical properties of the candidate estimators,

and inform the performance of the selection framework. These tools help

build intuition about these estimators’ behavior and allows for the

evaluation of their performance over varying inputs.

Summary Method

The summary() method for cvCovEst accepts

an object argument, a named list of class

cvCovEst, a dat_orig argument, the original

data used to calculate the covariance matrix estimates, and a

summ_fun argument, a character vector specifying the type

of summary function to use.

These summary functions allow the user to quickly compare the

performance of several classes of estimators and compute other metrics

of interest. The choices of summ_fun and their outputs are

described below:

| Summary | Implementation | Description |

|---|---|---|

| Empirical Risk by Estimator Class | empRiskByClass |

Returns the minimum, 1st quartile, median, 3rd

quartile, and maximum of the empirical risk associated with each class

of estimator passed to cvCovEst(). |

| Best Performing Estimator by Class | bestInClass |

Returns the specific hyperparameters, if applicable, of the best performing estimator within each class along with additional metrics. |

| Worst Performing Estimator by Class | worstInClass |

Returns the specific hyperparameters, if applicable, of the worst performing estimator within each class along with additional metrics. |

| Empirical Risk by Hyperparameter | hyperRisk |

For estimators that take hyperparameters as arguments, this returns

the hyperparameters associated with the minimum, 1st

quartile, median, 3rd quartile, and maximum of the empirical

risk within each class of estimator. Each class has its own

tibble which are returned as a list. |

When either bestInClass or worstInClass is

specified, the additional metrics are the condition number, the sign,

and the sparsity. Sign refers to the estimate’s sign and is one of

positive-definite ("PD"), positive-semi-definite (“PSD”),

negative-definite (“ND”), negative-semi-definite (“NSD”), or indefinite

(“IND”). If an estimate results in a zero matrix, then the sign is

returned as "NA". Sparsity is calculated at the proportion

of total entries in the estimate which are equal to zero.

Plot Method

The plot() method for cvCovEst allows users

to visualize three main plot_types of the candidate

estimators: covariance heat maps (heatmap), eigenvalue

plots (eigen), and the empirical risk (risk)

as a function of the hyperparameters (for applicable estimator classes).

If users do not specify a plot type, then all three plots are combined

into one figure for the optimal estimator selected by

cvCovEst(). Users can also achieve this by setting

plot_type = "summary".

The heat maps and eigenvalue plots facilitate comparisons both within

and between estimator classes by allowing multiple values to be passed

as estimator and stat arguments.

Additional arguments specific to each plot_type are

outlined below:

Heat Map

| Argument | Description |

|---|---|

| abs_v | If TRUE, then the absolute value of the covariance is

mapped. Otherwise, the signed value is used. |

Eigenvalue Plot

| Argument | Description |

|---|---|

| leading | If TRUE, then the k leading eigenvalues are displayed.

Otherwise, the k trailing eigenvalues are displayed. |

| k | The number of leading or trailing eigenvalues to plot. |

Empirical Risk

These two additional arguments only apply to estimators with multiple hyperparameters:

| Argument | Description |

|---|---|

| switch_vars | If TRUE, the hyperparameters used for the x-axis and

factor variables are switched. |

| min_max | If TRUE, only the minimum and maximum values of the

factor hyperparameter will be used. |

Simulated Data Analysis Example

To show how the plot and summary methods can be used, data is

simulated from a predetermined covariance matrix following a Toeplitz

structure. The data is then passed to cvCovEst() along with

a handful of estimators.

set.seed(1584)

toep_sim <- function(p, rho, alpha) {

times <- seq_len(p)

H <- abs(outer(times, times, "-")) + diag(p)

H <- H^-(1 + alpha) * rho

covmat <- H + diag(p) * (1 - rho)

sign_mat <- sapply(

times,

function(i) {

sapply(

times,

function(j) {

(-1)^(abs(i - j))

}

)

}

)

return(covmat * sign_mat)

}

# simulate a 100 x 100 covariance matrix

sim_covmat <- toep_sim(p = 100, rho = 0.6, alpha = 0.3)

# sample 75 observations from multivariate normal mean = 0, var = sim_covmat

sim_dat <- MASS::mvrnorm(n = 100, mu = rep(0, 100), Sigma = sim_covmat)

# run CV-selector

cv_cov_est_sim <- cvCovEst(

dat = sim_dat,

estimators = c(

linearShrinkEst, thresholdingEst, bandingEst, adaptiveLassoEst,

sampleCovEst, taperingEst

),

estimator_params = list(

linearShrinkEst = list(alpha = seq(0.25, 0.75, 0.05)),

thresholdingEst = list(gamma = seq(0.25, 0.75, 0.05)),

bandingEst = list(k = seq(2L, 10L, 2L)),

adaptiveLassoEst = list(lambda = c(0.1, 0.25, 0.5, 0.75, 1), n = seq(1, 5)),

taperingEst = list(k = seq(2L, 10L, 2L))

),

cv_scheme = "v_fold",

v_folds = 5

)Summary Method

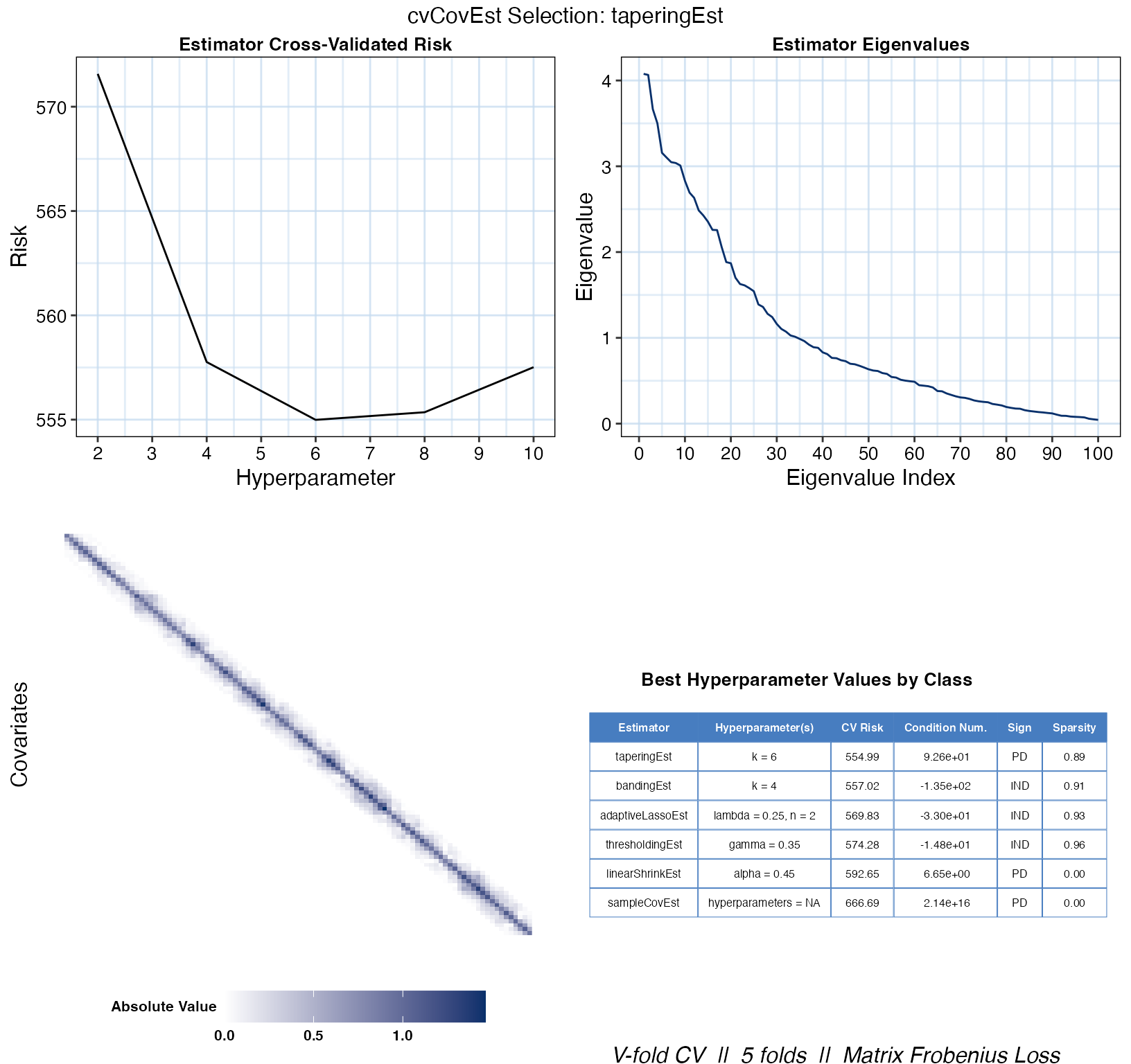

The summary() method is then used to compare the best

performing estimators in each class:

cv_sum <- summary(cv_cov_est_sim, dat_orig = sim_dat)

cv_sum$bestInClass## # A tibble: 6 × 6

## estimator hyperparameter cv_risk cond_num sign sparsity

## <chr> <chr> <dbl> <dbl> <chr> <dbl>

## 1 taperingEst k = 6 555. 9.26e 1 PD 0.89

## 2 bandingEst k = 4 557. -1.35e 2 IND 0.91

## 3 adaptiveLassoEst lambda = 0.25, n = 2 570. -3.3 e 1 IND 0.93

## 4 thresholdingEst gamma = 0.35 574. -1.48e 1 IND 0.96

## 5 linearShrinkEst alpha = 0.45 593. 6.65e 0 PD 0

## 6 sampleCovEst hyperparameters = NA 667. 2.14e16 PD 0In this case, the tapering estimator with k = 6 achieves

the lowest empirical risk. It is also one of the few positive definite

matrices, though its condition number is worse than that of the linear

shrinkage estimator’s estimate. The resulting estimate is also less

sparse than that of the other sparsity-enforcing estimators “best”

estimates.

We can take a closer look at the estimator’s performance based on

other possible hyperparameter values by hashing taperingEst

from the hyperRisk list.

cv_sum$hyperRisk$taperingEst## # A tibble: 5 × 3

## hyperparameters cv_risk stat

## <chr> <chr> <chr>

## 1 k = 6 555 min

## 2 k = 6 555 Q1

## 3 k = 6 555 median

## 4 k = 4 558 Q3

## 5 k = 2 572 maxPlot Method

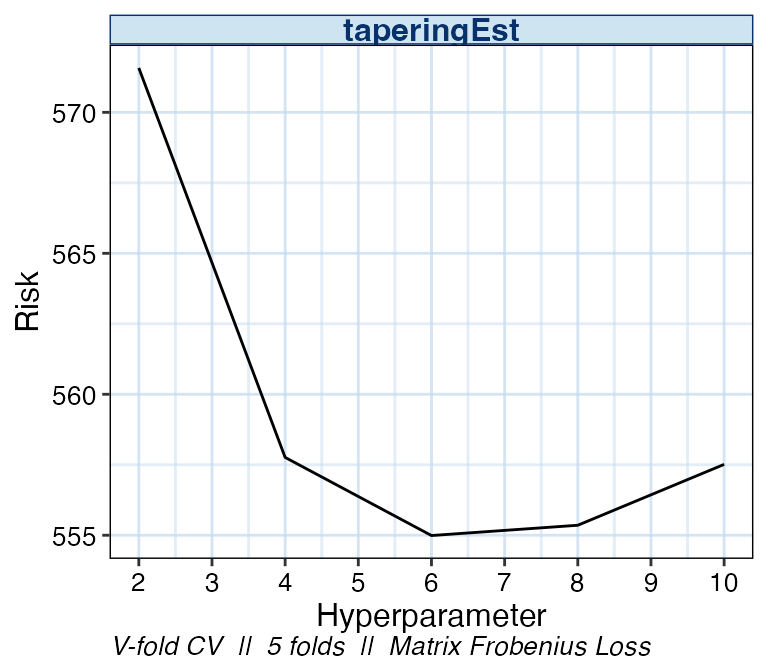

By specifying plot_type = "risk", we can see the change

in empirical risk as the value of k changes. A summary of

the cross-validation scheme and loss function is displayed at the bottom

of all cvCovEst plot outputs.

plot(cv_cov_est_sim, dat_orig = sim_dat, plot_type = "risk")

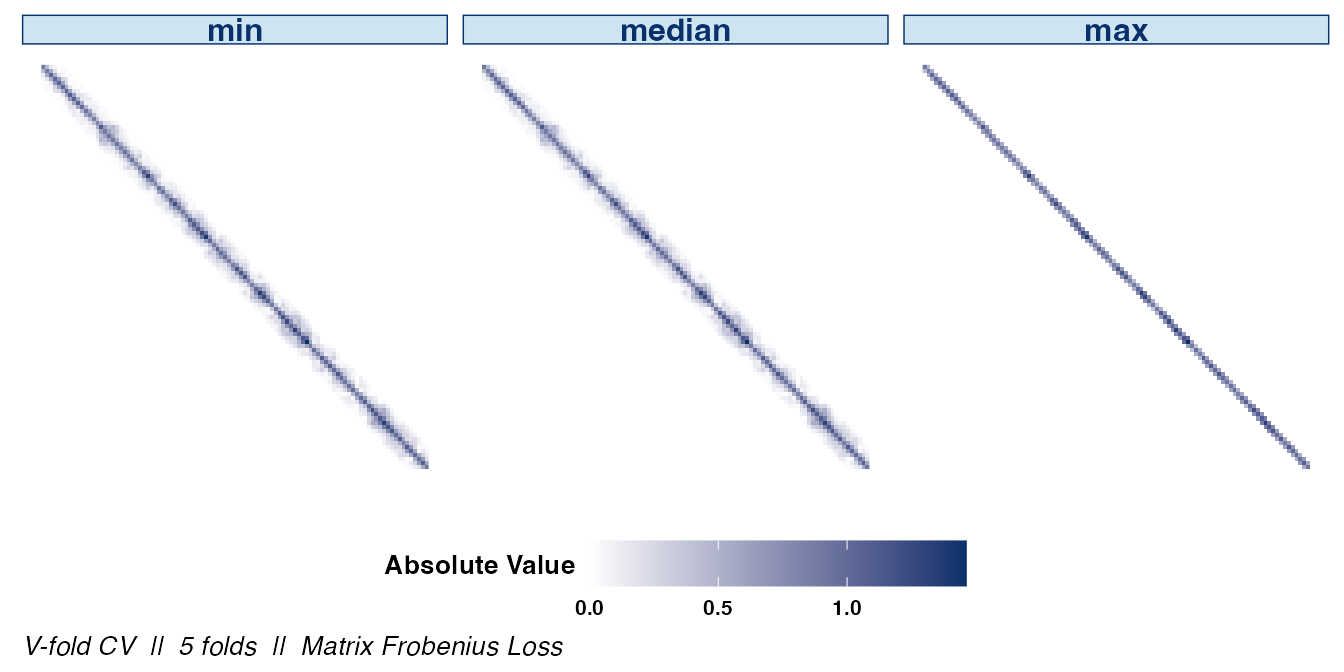

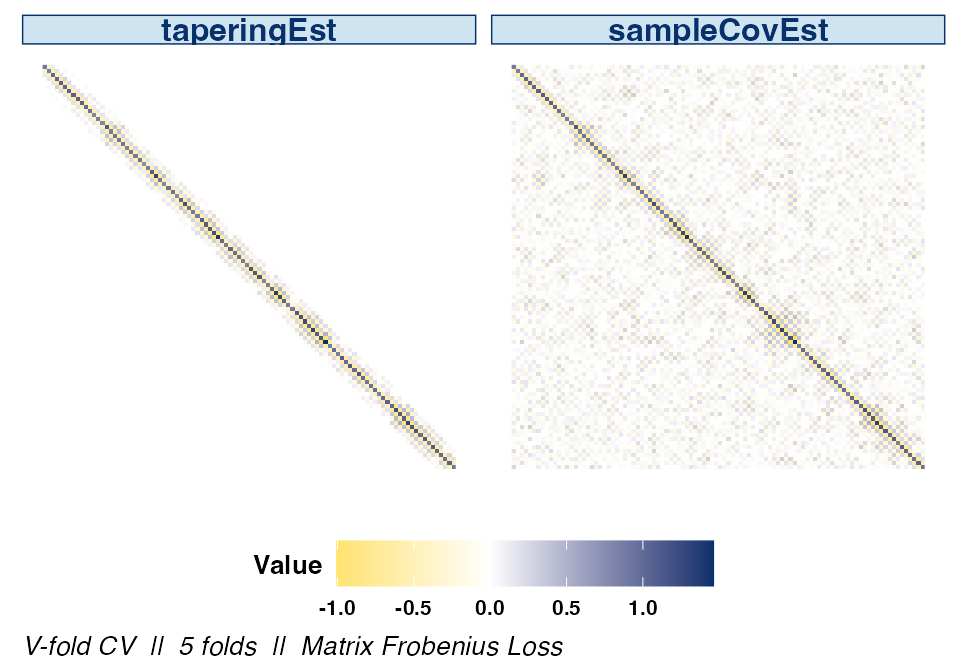

We can also examine the matrix structure as the value of

k changes. Examining the overall sparsity of the resulting

estimator can be useful since, in some cases, the assumption of sparsity

is not warranted. Note that the absolute values of the estimate’s

entries are displayed to emphasize the structural differences between

choices of hyperparameters.

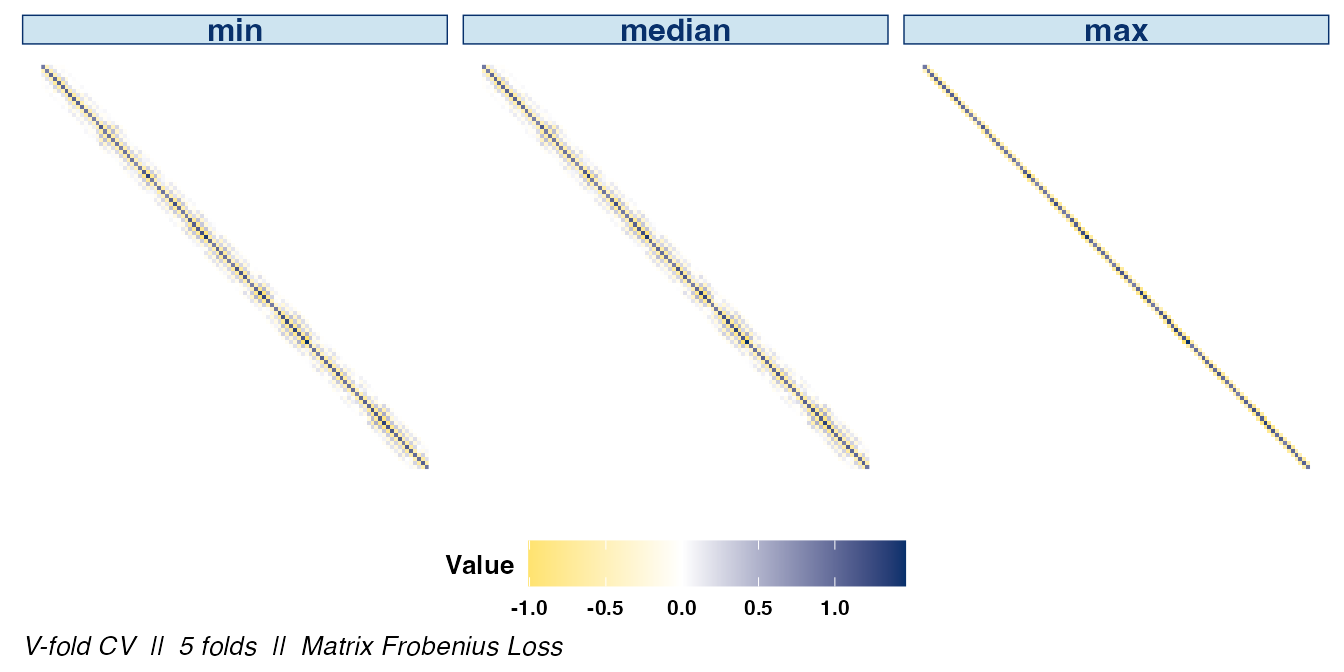

If the signs of the covariances are of interest, they can be

displayed by setting abs_v = FALSE:

plot(cv_cov_est_sim, dat_orig = sim_dat, plot_type = "heatmap",

stat = c("min", "median", "max"), abs_v = FALSE)

The difference between the optimal estimator selected by

cvCovEst() and the sample covariance matrix is clear when

displaying their respective heat maps side by side.

plot(cv_cov_est_sim, dat_orig = sim_dat, plot_type = "heatmap",

estimator = c("taperingEst", "sampleCovEst"),

stat = c("min"), abs_v = FALSE)

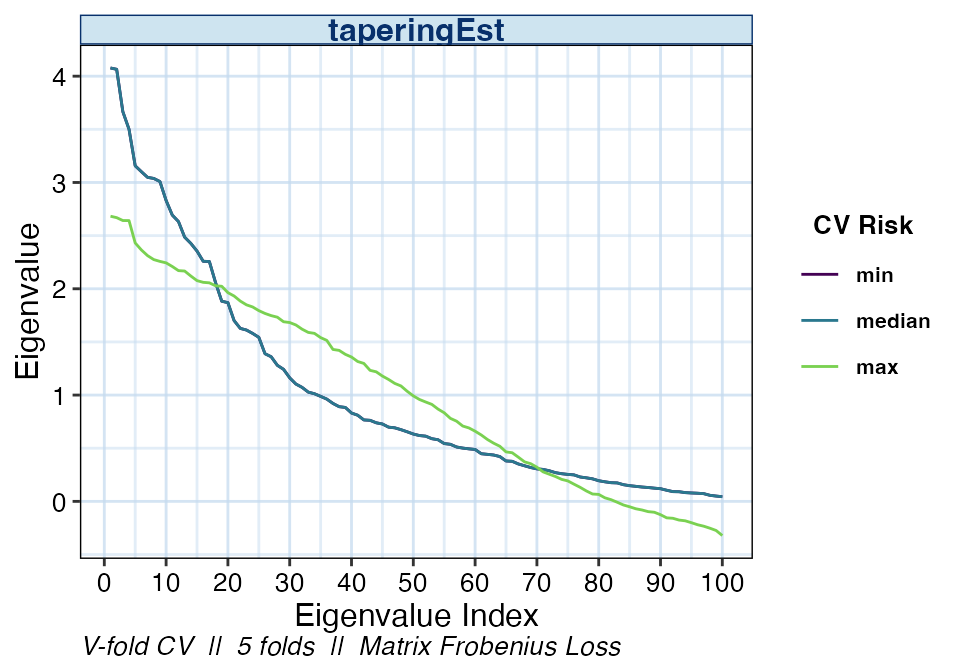

We may also be interested in the eigenvalues of the various banding

estimators. The distribution of eigenvalues relays information such as

the condition number or the positive-definiteness of the resulting

estimator. As with the other plot types, if the estimator

argument is not specified, the default is to display the optimal

estimator selected by cvCovEst().

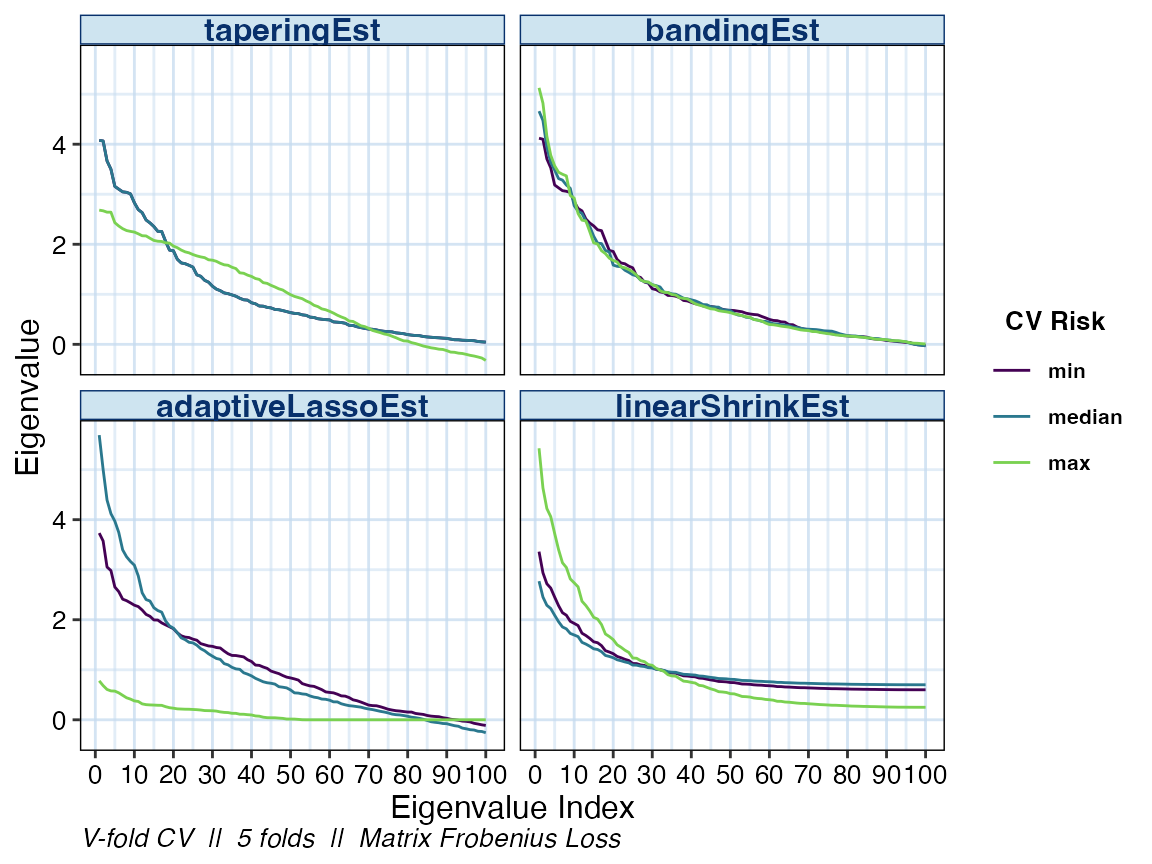

Specifying multiple values in the estimator argument

allows us compare the eigenvalues of the other estimator classes as

well.

plot(cv_cov_est_sim, dat_orig = sim_dat, plot_type = "eigen",

stat = c("min", "median", "max"),

estimator = c("taperingEst", "bandingEst", "linearShrinkEst",

"adaptiveLassoEst"))

As previously mentioned, simply calling the plot() on

the output of cvCovEst() and providing the original data

will result in a visual summary of the selected estimator.

plot(cv_cov_est_sim, dat_orig = sim_dat)